Wheaton's Flexible Giving Account

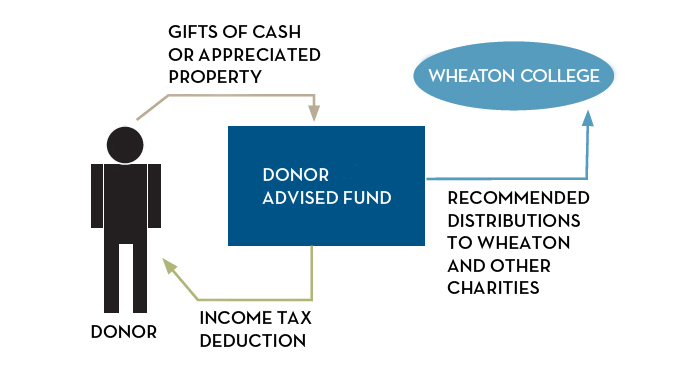

A Wheaton College Donor Advised Fund (DAF) is a flexible and convenient giving account that allows you to give to Wheaton and simplify giving to other charities.

- You can make recommendations for gifts to your favorite charities now and in the future.

- A DAF can receive gifts of cash, appreciated securities, and real estate.

- If giving appreciated assets, avoid capital gains taxes that would have been due at a sale.

- “Bunch” years of giving into a single year to itemize deductions, and then make recommendations for distributions in the future.

- Receive one receipt for income tax purposes.

- Donate assets that would otherwise be difficult or inconvenient to split between charities.

Financial strength: long-term DAF accounts are invested through Wheaton College Trust Company, N.A. in the same well-managed investment pools as Wheaton’s endowment. - Build a charitable legacy: as a simpler alternative to a private family foundation, you can create an endowment to support charities now and after your passing. You can pass on recommendation duties to loved ones to share in the joy of giving!

/prod02/channel_1/media/giving/DAF-Booklet-and-Info-Sheet-Thumbnail.jpg)