What is a Charitable Remainder Unitrust?

A charitable remainder unitrust (CRUT) is a giving vehicle that allows a donor to create an income flow (for themselves / others), and make a significant gift to Wheaton College! There are 2 main types of CRUTs with unique benefits: During-Life and Testamentary.

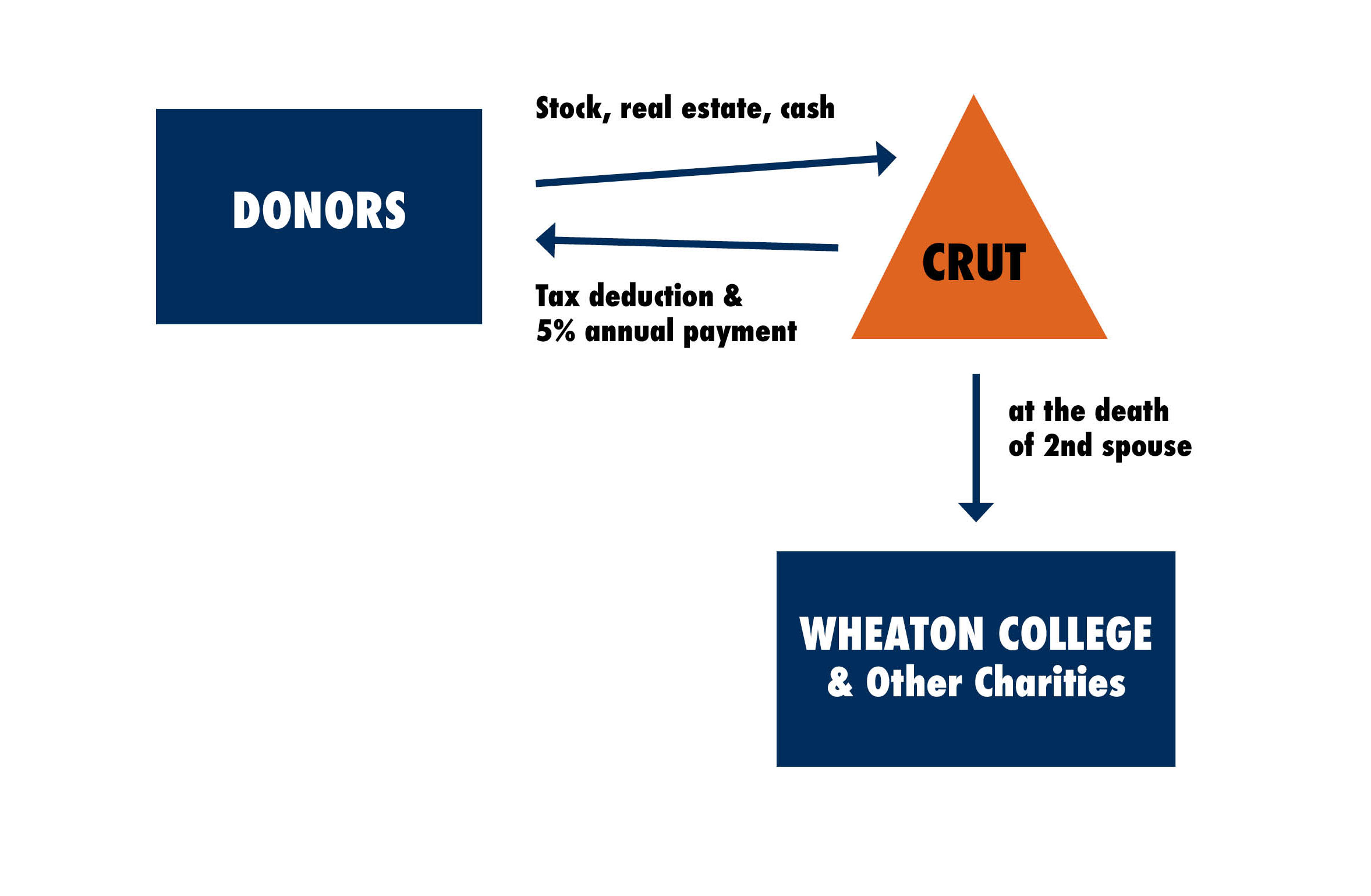

During-Life CRUT

Want an extra income flow in retirement? Have appreciated assets, but concerned about capital gains tax? Want a charitable income tax deduction? A during-life CRUT may be for you!

You can fund a during-life CRUT with appreciated assets (or cash), and Wheaton College Trust Company can administer it. The CRUT will sell the assets – avoiding immediate capital gains tax – and reinvest in a diversified portfolio. The CRUT pays you income for life. You will get a tax deduction, and Wheaton College (and possibly other charities) receive the remainder!

Fund a During-Life CRUT with appreciated assets or cash

- If using appreciated stock or real estate, there are added benefits:

- Avoiding immediate capital gains tax from a sale

- The remaining gains are spread out over your payments

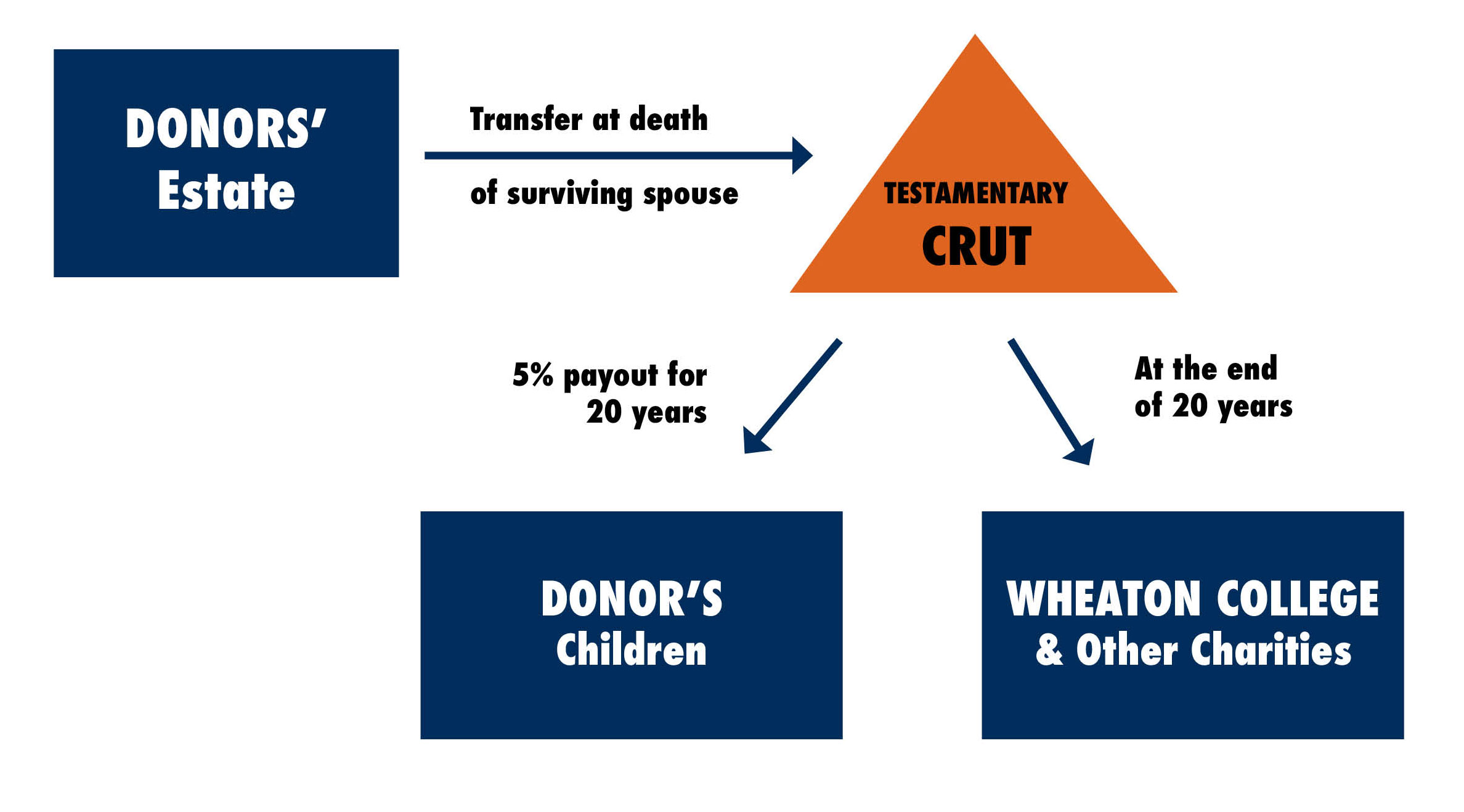

Testamentary CRUT – the “Give it Twice Trust”

Want to create an income flow for your children in your estate plan (vs. one large lump sum inheritance)? With a testamentary CRUT, you can – and support Wheaton College, too!

A testamentary CRUT is funded through your estate and pays income to beneficiaries for up to 20 years. Payments are based on a fixed percentage of the CRUT’s value (revalued annually).

After, Wheaton (and possibly other charities) receive the remainder!

Fund a testamentary CRUT with retirement assets (IRA, 401k, 403b, etc.), other assets, or cash

- If using tax-deferred (traditional) retirement assets, there are added benefits:

- The CRUT pays your beneficiaries for up to 20 years (vs. the 10-year rule for inherited accounts under SECURE Act)

- Assets stay in tax-deferred environment while CRUT makes payments to beneficiaries

Give it Twice Example

Max directs his $500,000 traditional IRA to a testamentary CRUT. At his death, the CRUT pays 5% per year to his daughter ($25,000 in the first year). Assuming neither growth nor decline*, the CRUT pays his daughter a total of $500,000 over 20 years! ($25,000 x 20 years). After, Wheaton receives the remainder – approximately equal to the $500,000 funding amount!

/prod02/channel_1/media/giving/Charitable-Remainder-Trust-Worksheet-Thumbnail.jpg)